Startup Growth Metrics: Why Some Succeed and Others Don’t

Category: Business

Over the past decade, the startup scene has shifted from something small and experimental to one of the most exciting parts of the global tech conversation as many young people dream of starting a business. According to the Global Entrepreneurship Monitor (GEM) USA report, “24% of 18–24-year-olds are currently entrepreneurs”. A report from Simply Business (2025) shows that nearly 60% of young people in the UK say they dream of starting their own business. The Avendus-Hurun data (2025) shows that many under-30 Indian entrepreneurs are raising significant capital and generating large employment impact. The vibe isn’t different in key cities of Africa like Lagos, Nairobi, Accra or Cape Town — young founders are working on apps and platforms that solve everyday problems.

Unfortunately, all startups do not grow at the same pace and many still failed despite their great ideas. Some scale quickly, attract international investors, and build strong teams. Others struggle to stay alive beyond the first few years. The key factor that separates these two groups is how well founders understand growth metrics — the simple but powerful numbers that show whether a business is healthy or heading in the wrong direction. Whether you’re a startup owner, a well experienced business founder or you are just conceiving an idea but do not know how to grow it, I am certain that you will get something to benefit from reading this blog. While most of the data or statistics are from Africa startups – the lessons are universally applicable.

What the Numbers Say About the African Startup

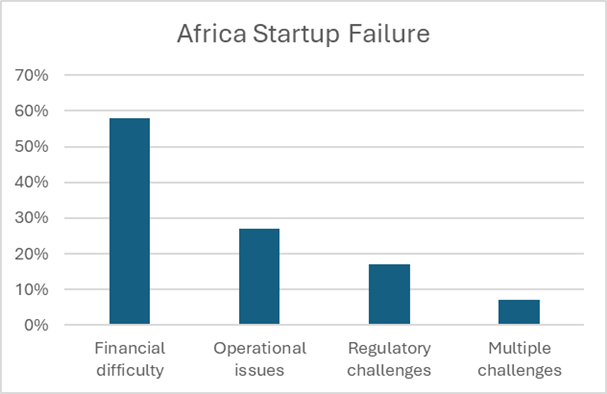

While Africa is struggling in the tech sector, it cannot be said to be a passive observer. Things are changing and are moving faster than before. For instance, Partech Africa 2022 report shows that African startups raised around $4.8 billion in funding, and Nigeria, Kenya, Egypt and South Africa—accounted for 72% of it. This figure is significant because that amount was achieved despite reduction in global funding. In a similar trend, report also indicated that more than half of African startups fail within their first three years (Startup Genome, 2023). The chart below highlighted some key reasons for their failure as against the percentage rate of failure.

These figures paint a mixed but interesting picture. There are momentum and opportunity, yes, but also high risk, fast-changing markets and tough realities. The focus here isn’t why they fail, because there are always reasons for failure and these reasons are not unique to startups of a given region. I am interested in sharing why understanding some growth metrics helps founders navigate today’s competitive business environment without wasting resources or losing direction.

Why Growth Metrics Matter More Than Assumptions

A common issue across many startups is that founders sometimes rely on passion and early excitement instead of data. Passion is important, no doubt, but it’s not enough to sustain a company in the long run. For instance, with growth metrics you could answer important questions such as:

Am I gaining customers at a reasonable cost?

Are my customers staying, or are they leaving after a single try?

Is my business burning too much cash?

Which part of my company’s product or service do people use?

Can I scale without collapsing?

Without these insights, even the most brilliant idea can slowly fall apart. On the other hand, understanding these metrics would be a road map to a successful business operation.

The Key Metrics Every Startups Should Track

Below are the growth metrics that make the biggest difference, especially in tough business environments.

1. Customer Acquisition Cost (CAC):

This is how much you spend to get a customer. Most early-stage startups in often underestimate CAC because they rely heavily on social media ads, discounts or influencers. If your CAC is too high, it becomes difficult to make profit.

A good example is a Kenyan fintech that spent aggressively on adverts but realised later that the users they attracted regularly deposited very small amounts. The business eventually slowed down because the marketing cost didn’t match the revenue.

2. Lifetime Value (LTV):

LTV shows how much money a customer brings into your business over time. Investors prefer businesses where LTV is higher than CAC. If customers leave too early, the company loses money even if it attracts many people.

3. Monthly Recurring Revenue (MRR):

This is crucial for subscription-based products such as education platforms, online medical services or enterprise software. MRR helps predict how much money will come in every month. Personal interaction with some respected individuals has reiterated to me that UK and US investors, pay close attention to this metric because it shows consistency.

4. Retention Rate:

Retention simply means keeping your customers. A report from AfricArena showed that startups with strong retention (above 60%) were three times more likely to grow into regional or global brands. It seems right to say that retention could sometimes be more valuable than growth because a loyal customer base reduces marketing costs and this will translate into a sustainable growth.

5. Burn Rate:

Burn rate refers to how fast a startup spends its money on a monthly basis. Several startups have collapsed because their burn rate became too high. The Nigerian Startup Failure Index suggests that 31% of failed startups ran out of cash within 18 months of business operations. A startup might look successful from the outside, considering how thousands of individuals have used social media to flag their businesses as “successful”. Realistically, if the money is finishing faster than income, it is a terrible sign that trouble is looming. Be careful not to confuse burn rate with normal moderate startup expenses which are long-term accounting losses. If you think you need more clarification on this, please for free for more information.

6. Gross Margin:

Gross margin is an indication of how profitable your core product is. In other words, it is the money a business keeps after subtracting the cost of making the product or delivering the service. It tells you how much money is left to take care of other expenses like salaries, marketing, rent, etc. This metric is significant to every startup because in many cases production/delivery cost is often exponentially high and should not be under-estimated.

What Successful Startups Do Differently

There’s no perfect formula for success, but the startups that manage to grow sustainably often share a few similar characteristics.

They Solve Real Problems: The best African startups don’t force ideas; they respond to real needs. Flutter Wave simplified online payments. Twiga Foods improved sourcing for African vendors. M-KOPA made solar power more accessible. Because these companies serve practical needs, growth became easier. As a startup, seatback a bit, think and ask yourself: what real world problem do my business intends to solve? Your answer to this question will reveal your potential for future success.

They Understand Their Data: Successful founders don’t wait for investors to check their numbers—they monitor them weekly. Paystack, for example, focused on retention early on. Instead of rushing to expand, they spent time making their product genuinely useful for small businesses. No doubt, understanding data is crucial for every startup because it provides clear evidence for making smarter decisions, avoiding costly mistakes, and steering the business toward sustainable growth.

They Manage Cash Wisely: As noted in the Partech Africa Tech VC Report (2023), “as the influx of capital dried up, companies strived to control cash burn. Founders had to learn the importance of being ‘default alive’, i.e. simply not dying if the next fundraising target was missed” - that statement strongly suggests that cash discipline and runway planning became central to strategy for African startups, especially in tougher funding environments. Many of these startups grew slowly at first. They avoided fancy offices, reduced unnecessary spending and ensured that every hire had clear value. This eventually paid off.

They Build Trust: In markets where fraud, network issues and poor customer support are common, trust becomes a major strength. Startups that reply quickly, keep promises and offer steady service could easily outperform competitors with bigger budgets.

They Form Partnerships: Partnerships with banks, telecom companies, NGOs or government bodies can rapidly increase reach. Granted, this is one of the most challenging aspects for startup with limited resources, but it is achievable in time with consistency and proper understanding and utilization of the right metrics.

CONCLUSION

The world has no shortage of talents or ideas. What makes the difference is how founders use information—especially growth metrics—to guide their decisions. Understanding your numbers doesn’t replace creativity, but it supports it. It helps you shape a product that works, run a business that lasts, and make decisions that investors and customers can believe in.

By paying closer attention to these essential metrics, every startup has a stronger chance of not only surviving but also scaling across the globe. Looking for a more personalised information or you have a question that you think is unique to you? You could write to today for a guidance.

Back to Posts